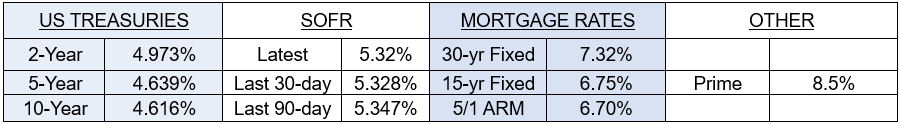

Key Rate Indices

State of the Market

| Below is a summary of some of the most important recent economic releases:

The Federal Reserve’s preferred inflation measure, PCE, was somewhat re-accelerated in March. This topic will be discussed at length later in the newsletter. Real GDP increased at 1.6% Annualized Rate in Q1 The U.S. economy grew at a slower pace than expected in the first quarter of 2024, with real GDP expanding at a 1.6% annualized rate. This growth rate is lower than the 2.6% annualized rate recorded in the fourth quarter of 2023. Weekly Initial Unemployment Claims Decrease to 207,000 The number of Americans filing new claims for unemployment benefits fell to 207,000 in the week ending April 20, 2024, marking a decrease from the previous week’s revised level of 215,000. This decline suggests that the labor market remains resilient, despite concerns about a potential economic slowdown. The AIA’s Architecture Billings Index (ABI) indicated a further contraction in architecture firm billings in March 2024, with the index falling to 47.2 (any score below 50 indicates a decrease in billings). The multi-family sector has been particularly affected, with billings declining for the 20th consecutive month, highlighting the ongoing challenges faced by the multi-family housing market. |

Multifamily Starts Down Big – 44% YoY in March

|

The U.S. housing market showed mixed results in March 2024, with overall housing starts and building permits experiencing declines compared to the previous month. Single-family housing starts and authorizations decreased from February but demonstrated YoY growth, while multifamily starts and authorizations saw significant YoY declines. |

|

|

Single-Family Housing (SFH)

Multifamily:

Overall:

|

Inflation Concerns Persist

|

The Federal Reserve’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) price index, increased by 2.8% in March 2024 compared to the same month a year earlier, surpassing economists’ expectations. |

|

|

Some thoughts from this data release: Housing inflation is still keeping overall inflation numbers higher than desired.

Once accounting for housing inflation data, PCE and CPI are both very close to the Fed’s target inflation range.

Persistent inflation continues to push back interest rate cuts.

|

For more information, questions, or comments, please call or email.

Drew Daly

Managing Partner

C: (206) 228-6166

E: ddaly@nlakemanagement.com